How Much Does a Pyrolysis Plant Cost in 2026?

Pyrolysis plant costs range from $20,000 for a small 1-3 TPD pilot batch reactor to over $25 million for a large-scale 100+ TPD continuous turnkey facility. The total investment depends on processing capacity, feedstock type (plastic, tire, or biomass), plant configuration (batch vs. continuous), supplier origin, automation level, oil purification requirements, and certifications like ISCC Plus.

This is the most comprehensive pyrolysis plant cost guide available in 2026 — compiled from APChemi's experience across 49+ commercial projects worldwide, combined with current market data from Chinese, Indian, European, and global suppliers. Whether you're evaluating a small pyrolysis machine for tire recycling or planning a large-scale plastic-to-oil plant, this guide covers every cost factor with real pricing data.

In this guide: equipment cost by capacity, cost by feedstock type, batch vs. continuous cost comparison, operating costs, revenue streams and ROI analysis, regional price differences, government incentives, and how to reduce your total cost with APChemi's project management consultancy.

Pyrolysis Plant Cost by Capacity (1 TPD to 100+ TPD)

Processing capacity — measured in tonnes per day (TPD) — is the single biggest factor determining pyrolysis plant price. Larger plants have higher absolute costs but significantly lower per-tonne capital costs, delivering better economics at scale.

The table below shows equipment-only cost versus turnkey installed cost (including civil works, utilities, installation, commissioning, and training) across all commercial capacity ranges:

| Capacity | Plant Type | Equipment Cost | Turnkey Cost | Typical Origin | ROI Period |

|---|---|---|---|---|---|

| 1–3 TPD | Batch (Pilot) | $20,000 – $60,000 | $50,000 – $150,000 | China / India | 3 – 5 years |

| 5 TPD | Batch | $60,000 – $150,000 | $150,000 – $400,000 | China / India | 3 – 5 years |

| 10 TPD | Semi-Continuous | $150,000 – $400,000 | $400,000 – $1M | China / India / EU | 2.5 – 4 years |

| 20 TPD | Continuous | $400,000 – $1.5M | $1M – $3M | India / EU / Global | 2 – 3.5 years |

| 50 TPD | Continuous | $1.5M – $4M | $3M – $8M | EU / Global | 2 – 3 years |

| 100+ TPD | Multi-Line Continuous | $4M – $10M+ | $8M – $25M+ | EU / Global | 1.5 – 3 years |

* Costs based on 2024–2026 market data from Chinese, Indian, and European suppliers. Equipment cost = reactor + condenser + core machinery. Turnkey cost = equipment + civil works + utilities + installation + commissioning + training. Actual costs vary by feedstock, location, and specifications. Contact APChemi for a precise quote.

Need an accurate cost estimate for your specific project? APChemi provides free, detailed cost breakdowns based on 49+ commercial project benchmarks.

Pyrolysis Plant Cost by Feedstock Type

Different waste feedstocks require different pre-processing equipment, reactor configurations, and output handling systems — all of which affect the total plant cost. Here's how costs compare for a 10 TPD equivalent plant:

| Feedstock | Equipment Cost (10 TPD) | Oil Yield | Key Outputs | Cost Notes |

|---|---|---|---|---|

| Mixed Plastic Waste | $60,000 – $500,000 | 60–80% | Pyrolysis Oil, Wax, Gas | Pre-sorting and washing adds 10–20% to CAPEX |

| End-of-Life Tires | $80,000 – $600,000 | 40–50% | Oil, Carbon Black, Steel, Gas | Shredding equipment adds $20K–$80K |

| Biomass / Agri-Waste | $50,000 – $400,000 | 30–45% bio-oil | Biochar, Bio-oil, Syngas | 20–40% cheaper equipment than plastic/tire |

| Multi-Layer Packaging | $100,000 – $600,000 | 55–75% | Oil, Aluminium, Gas | De-lamination pre-processing required |

| Municipal Solid Waste (RDF) | $200,000 – $1M+ | 20–40% | Oil, Char, Gas | Requires extensive pre-processing and sorting |

* Equipment costs for 10 TPD class plants from Chinese and Indian suppliers. European equipment costs 20–40% more. Biomass pyrolysis equipment is typically 20–40% cheaper than plastic or tire equivalents.

Key Insight: Feedstock Pre-Processing Adds 10–30% to CAPEX

Tire plants need shredding lines ($20,000–$80,000). Plastic plants need sorting and washing systems ($30,000–$100,000). Biomass may need drying and size-reduction equipment ($15,000–$50,000). Multi-layer packaging requires de-lamination. Always budget for pre-processing when comparing pyrolysis plant prices — many manufacturers quote reactor-only prices that exclude these essential systems.

Batch vs. Continuous Pyrolysis Plant: Complete Cost Comparison

The choice between batch and continuous pyrolysis plant operation is one of the most important cost decisions. Batch plants are cheaper upfront but continuous plants deliver dramatically better economics at scale:

| Cost Factor | Batch Pyrolysis Plant | Continuous Pyrolysis Plant |

|---|---|---|

| Equipment Cost (10 TPD) | $60,000 – $200,000 | $300,000 – $1,500,000 |

| OPEX per Tonne | $60 – $90 | $30 – $60 |

| Labor per Shift | 10 – 20 workers | 4 – 8 workers |

| Energy Efficiency | Lower (heat-cool cycles) | Higher (continuous heat recovery) |

| Product Consistency | Variable batch-to-batch | Consistent quality output |

| Uptime / Utilization | 50 – 65% | 80 – 92% |

| ISCC Plus Certification | Difficult / Not feasible | Feasible (required for circular economy) |

| Suitable Capacity Range | 1 – 15 TPD | 15 – 100+ TPD |

| Automation Level | Manual / Semi-auto | PLC/SCADA fully automated |

| Typical ROI Period | 3 – 6 years | 2 – 3.5 years |

* Comparison based on industry data and APChemi's project benchmarks. Continuous plants are recommended for commercial operations above 15 TPD.

APChemi's Recommendation

For serious commercial operations, continuous pyrolysis plants deliver 40–60% lower operating costs per tonne compared to batch systems. The higher upfront investment is typically recovered within 12–18 months through reduced labor, better energy efficiency, and consistent product quality. Continuous operation is also a prerequisite for ISCC Plus certification — which unlocks premium circular feedstock pricing of $700–$1,100/MT for pyrolysis oil.

7 Key Factors That Affect Pyrolysis Plant Cost

1. Plant Capacity (TPD)

The single largest cost driver. A 50 TPD plant costs 3–4x more than a 10 TPD plant in absolute terms, but processes 5x more material — resulting in 30–50% lower per-tonne capital costs. For commercial viability, APChemi recommends a minimum of 10 TPD continuous operation.

2. Feedstock Type & Pre-Processing

Different waste streams require different reactor designs and pre-processing systems. Tire pyrolysis needs shredders and steel separation. Plastic pyrolysis needs sorting, washing, and drying. Biomass may need size reduction and moisture control. Pre-processing adds 10–30% to total CAPEX.

3. Batch vs. Continuous Operation

Continuous plants cost 2–5x more upfront but deliver 40–60% lower per-tonne operating costs. For capacities above 15 TPD, continuous systems are nearly always more economical over a 5-year horizon.

4. Automation & Control Systems

Fully automated plants with PLC/SCADA control, automated feeding, and remote monitoring add 15–25% to CAPEX but reduce labor requirements by 40–60%, improve product consistency, and enable 24/7 unmanned operation.

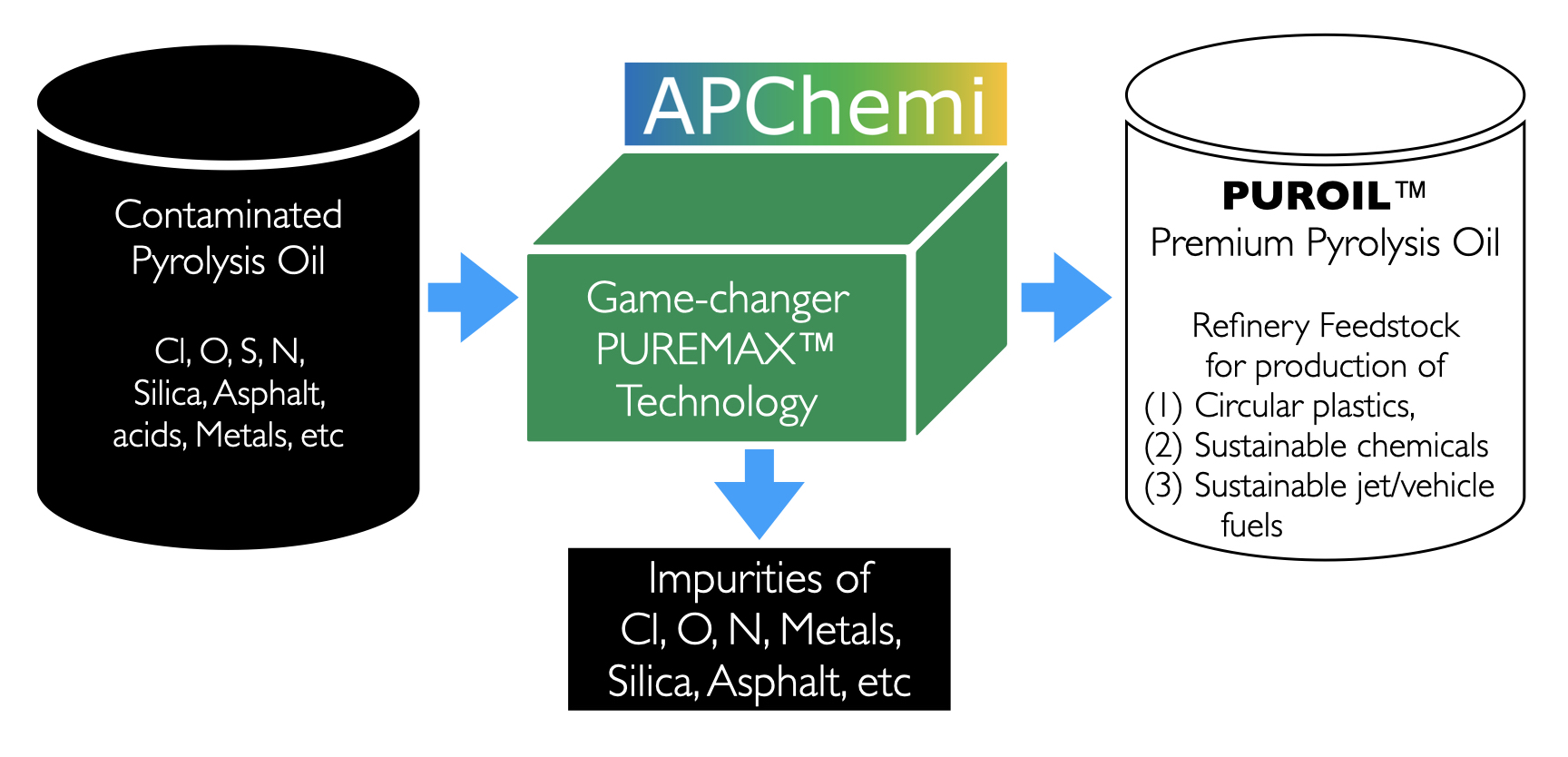

5. Oil Purification & Distillation

Adding fractional vacuum distillation for pyrolysis oil upgrading increases equipment cost by 20–40% but can double or triple the selling price of the output — from $400–$550/MT (crude oil) to $700–$1,100/MT (distilled/ISCC certified oil). APChemi's proprietary PUREMAX technology achieves 62% certified biofuel content.

6. Certifications (ISCC Plus, CE, ATEX)

ISCC Plus certification adds modest cost ($30,000–$80,000 for documentation and audits) but unlocks the premium circular plastics market where certified pyrolysis oil sells for 50–100% more than standard fuel markets. CE marking and ATEX compliance are mandatory for European installations and add 10–15% to equipment cost.

7. Location, Civil Works & Infrastructure

Site preparation, building construction, utility connections, roads, and local labor rates vary dramatically by region. Plants in developed markets (EU, US, Japan) cost 30–50% more in total installed cost compared to equivalent installations in India, Southeast Asia, or Africa. A 20 TPD plant typically needs 2,000–5,000 sqm of land.

Want APChemi to model the exact costs for your specific feedstock, location, and capacity? Our engineers provide free ROI projections based on 49+ commercial project benchmarks.

Pyrolysis Plant Cost by Region & Supplier Origin

Pyrolysis plant prices vary significantly depending on the supplier's country of origin. Chinese equipment is the most affordable, while European manufacturers charge a 20–40% premium for higher build quality, certifications, and stronger IP protection. Here's a regional breakdown:

| Region | Equipment Price Range | Key Advantage | Key Consideration |

|---|---|---|---|

| China | $20,000 – $500,000 | Lowest equipment cost (30–50% cheaper) | Variable quality; limited after-sales; IP concerns; shipping costs |

| India | $30,000 – $500,000 | Competitive pricing; strong engineering talent | Growing capability; verify certifications and references |

| Europe (EU) | $200,000 – $8,000,000 | Highest quality; ISCC/CE compliance built-in; strongest IP | 20–40% premium over Asian suppliers; longer lead times |

| North America | $250,000 – $5,000,000+ | Local support; regulatory compliance; IRA/45Z tax credits | Fewer specialized manufacturers; high labor costs |

| Turnkey (Global EPC) | $1M – $25M+ | Single point of responsibility; engineering + procurement + construction | Higher total cost but lower project risk |

Notable Manufacturers by Region

Chinese Suppliers

Niutech, Henan DOING, Beston Machinery, KingTiger Group — known for affordable batch and semi-continuous systems in the $20,000–$500,000 range.

Indian Suppliers

APChemi, Aswathi Industries, Klean Industries India — growing capability in both equipment manufacturing and turnkey project delivery.

European Suppliers

Pyrum (Germany), BTG BioLiquids (Netherlands), PYREG (Germany), Syncraft (Austria) — premium pricing with ISCC/CE compliance built in.

Global EPC Providers

Klean Industries (Canada), Quantafuel (Norway), APChemi (Netherlands/India/UK) — turnkey project delivery from feasibility to commissioning.

Pyrolysis Plant Operating Cost Breakdown (Monthly)

For a typical 20 TPD continuous pyrolysis plant, monthly operating costs range from $16,500 to $49,000 (approximately $30–$80 per tonne processed). Here's the detailed breakdown:

| Cost Item | Monthly Range (20 TPD) | % of Total OPEX | Details |

|---|---|---|---|

| Energy (Electricity + Startup Fuel) | $4,000 – $10,000 | 20–30% | Most plants achieve energy self-sufficiency using process gas after startup phase |

| Labor (Operators + Management) | $5,000 – $15,000 | 25–35% | Automated plants need 4–8 operators/shift vs. 10–20+ for manual plants |

| Maintenance & Spare Parts | $3,000 – $8,000 | 15–20% | Reactor maintenance, catalyst replacement, seals, and equipment servicing |

| Feedstock Logistics | $2,000 – $8,000 | 10–20% | Collection, transport, pre-processing, and storage of waste feedstock |

| Consumables & Chemicals | $1,000 – $4,000 | 5–10% | Catalysts, cleaning agents, nitrogen, and water treatment chemicals |

| Insurance, Permits & Admin | $1,500 – $4,000 | 5–10% | Plant insurance, environmental compliance, administration, and overhead |

* Operating costs based on 20 TPD continuous plant data. Batch plants have 30–50% higher per-tonne operating costs due to lower utilization and higher labor requirements.

How to Reduce Operating Costs

- 1. Energy self-sufficiency: Use non-condensable process gas as reactor fuel — eliminates $3,000–$8,000/month in external energy costs

- 2. Automation: PLC/SCADA systems reduce labor by 40–60%, saving $2,000–$6,000/month

- 3. Tipping fees: Charge waste generators $20–$120/tonne for processing — this offsets feedstock logistics costs entirely

- 4. Oil purification: Distilling crude oil to premium grades increases revenue 50–100%, improving net margins dramatically

Pyrolysis Plant Revenue Streams & ROI Analysis

A well-designed pyrolysis plant generates revenue from multiple product streams plus waste processing fees. Here are current market prices for pyrolysis outputs:

| Revenue Stream | Market Price (2026) | Typical Yield | Notes |

|---|---|---|---|

| Pyrolysis Oil (Crude) | $400 – $550/MT | 40–80% | Used as industrial fuel (HFO replacement) or marine fuel blend |

| Pyrolysis Oil (Distilled/Purified) | $600 – $900/MT | 35–70% | Premium price via fractional distillation — ISCC certified oil commands $700–$1,100/MT |

| Recovered Carbon Black (rCB) | $300 – $600/MT | 25–35% (tires) | Used in rubber compounding, inks, coatings. High-grade rCB fetches up to $900/MT |

| Biochar | $200 – $800/MT | 20–35% (biomass) | CDR carbon credits add $50–$150/tonne value. Industrial biocoal for smelting: $150–$400/MT |

| Steel Wire (Tires) | $150 – $250/MT | 10–15% (tires) | Recovered from tire pyrolysis and sold to scrap metal dealers |

| Non-Condensable Gas | Self-use / $0.03–$0.05/kWh | 10–20% | Used as process fuel — replaces external energy and achieves energy self-sufficiency |

| Tipping / Gate Fees | $20 – $120/tonne | N/A | Paid by waste generators for processing — revenue before production begins |

Sample ROI Calculation: 20 TPD Tire Pyrolysis Plant

Investment

Annual Revenue (85% utilization)

Annual Operating Cost

$780,000

Annual Net Profit

$2,414,000

Payback Period

~10 Months

* This is an illustrative scenario based on optimistic market conditions and high utilization rates. Actual results vary significantly by location, feedstock quality, product pricing, and operational efficiency. Independent analysis suggests typical payback periods of 2–4 years for well-managed plants. APChemi provides conservative, data-backed ROI projections based on 49+ commercial project benchmarks — request a free projection.

Want a detailed ROI projection for your specific feedstock, location, and capacity? APChemi's engineers model revenue scenarios based on 49+ project benchmarks.

Government Incentives & Subsidies for Pyrolysis Plants (2026)

Multiple governments offer significant financial incentives for pyrolysis and chemical recycling projects. These can reduce your effective investment by 20–60%:

United States: IRA Section 45Z Clean Fuel Production Credit

Up to $1.00/gallon for SAF; $0.20–$0.50/gallon for renewable fuelsAvailable from 2025 for qualified pyrolysis-derived fuels meeting carbon intensity thresholds

India: Waste-to-Value Subsidy + EPR Credits

Up to 30% capital subsidy; EPR credit revenueGovernment subsidies for waste processing plants; Extended Producer Responsibility credit monetization

European Union: EU Innovation Fund + National Grants

Up to 60% of project costsGrants for innovative low-carbon technologies; country-specific programs (Germany KfW, Netherlands RVO)

United Kingdom: Plastic Packaging Tax Offset + R&D Credits

£210.82/tonne tax on <30% recycled content packagingCreates demand for recycled content from chemical recycling; R&D tax credits for pyrolysis innovation

Middle East & Africa: Free Zone Benefits + Waste Processing Contracts

0% corporate tax in free zones; guaranteed feedstockUAE, Saudi Arabia, and African nations offering favorable terms for waste-to-value investments

How APChemi Reduces Your Total Pyrolysis Plant Cost

APChemi's project management consultancy delivers 2–5x capital efficiency over industry averages. Here's how:

Optimized Plant Design

Designs benchmarked against 49+ delivered projects eliminate over-engineering and unnecessary costs.

Oil Purification Technology

Proprietary PUREMAX distillation increases revenue per tonne by 50–100% — improving ROI without adding proportional CAPEX.

Energy-Efficient Reactors

Patented reactor designs reduce energy consumption by 20–30% vs. industry standard, cutting operating costs.

ISCC Plus Certification

Guidance through ISCC certification unlocks premium circular feedstock markets — adding $200–$500/MT to oil revenue.

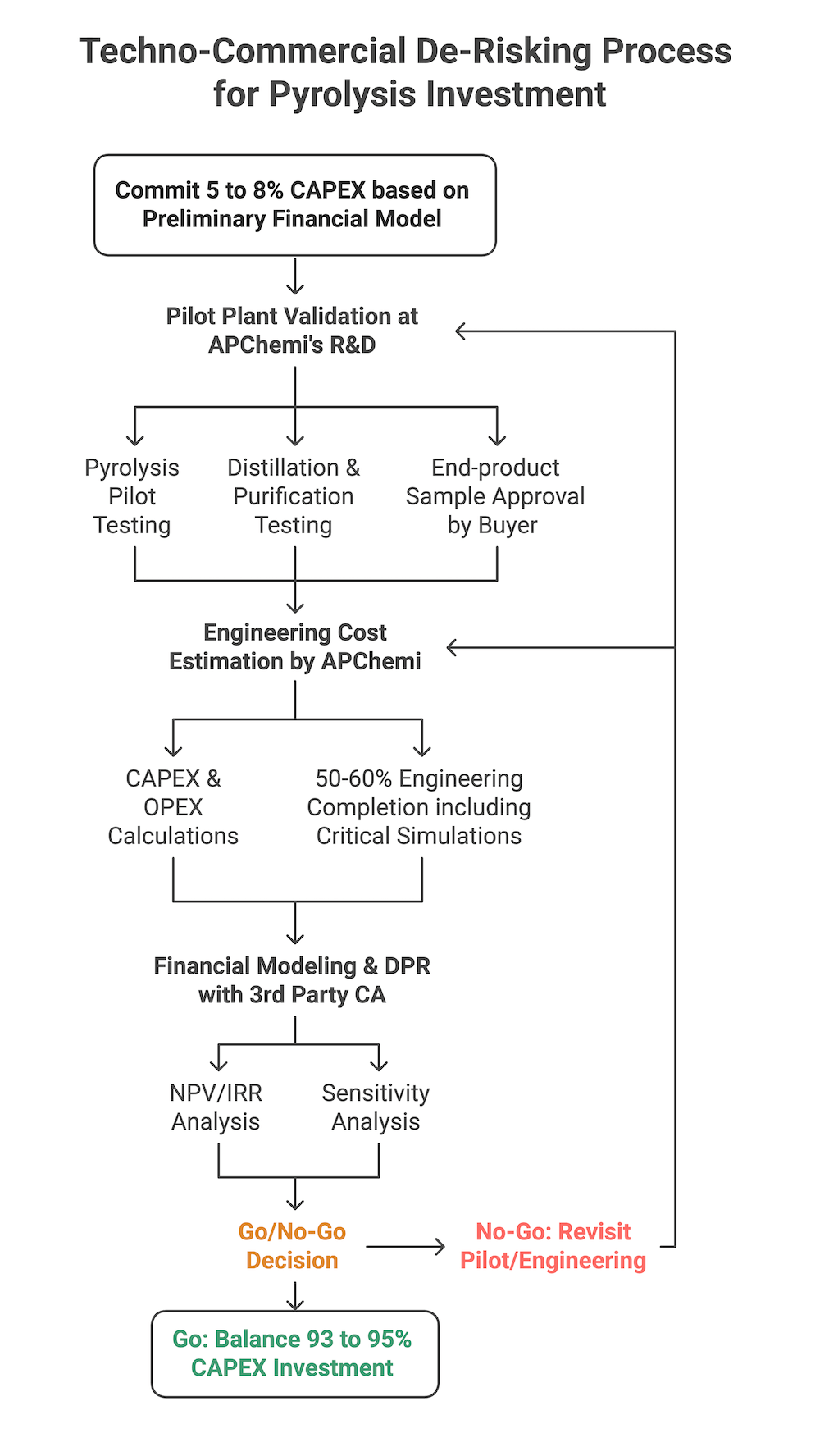

De-Risked Investment

Techno-commercial de-risking process lets you commit only 5–8% of CAPEX before the Go/No-Go decision.

Global Procurement

Leverage APChemi's global supplier network (Netherlands, India, UK) for competitive equipment pricing without sacrificing quality.

Pyrolysis Plant Market Size & Growth (2026–2031)

The global pyrolysis plant market is valued at approximately $935 million in 2024 and is projected to reach $1.58 billion by 2031, growing at a CAGR of 7.5–8%. Key drivers include:

- Mandatory plastic recycling targets in the EU (55% by 2030), UK, and emerging economies

- Corporate sustainability commitments driving demand for certified circular feedstock

- US Inflation Reduction Act (IRA) Section 45Z credits making pyrolysis-derived fuels economically attractive

- India's Extended Producer Responsibility (EPR) framework creating demand for plastic waste processing capacity

- Rising landfill costs and incineration restrictions in developed markets

- Growing biochar market for carbon dioxide removal (CDR) credits valued at $50–$150/tonne CO₂

Pyrolysis Plant Cost FAQs

Pyrolysis plant costs range from $200,000 for a small 5 TPD batch unit to over $5 million for a large-scale 50+ TPD continuous plant. The total investment depends on capacity, feedstock type, automation level, and whether oil purification/distillation is included. APChemi provides detailed cost breakdowns and ROI projections for each project.

A well-designed pyrolysis plant typically achieves ROI within 2-4 years. Key factors include feedstock cost (or tipping fees), output product prices (pyrolysis oil, carbon black, gas), plant utilization rate, and operational efficiency. APChemi's plants achieve 2-5x capital efficiency compared to industry averages.

Operating costs typically range from $30-80 per tonne of feedstock processed, covering energy, labor, maintenance, and consumables. Continuous plants have lower per-tonne costs than batch systems. APChemi's automated designs minimize labor requirements and maximize energy recovery from process gas.

Yes, pyrolysis plants are profitable when properly designed and managed. Revenue comes from tipping fees for waste processing, sale of pyrolysis oil (used as fuel or chemical feedstock), carbon black, steel wire (from tires), and process gas. ISCC Plus certification can further increase oil prices through sustainability credits.

Pyrolysis plant financing options include project finance, green bonds, government grants for waste-to-value projects, carbon credit revenue-backed loans, and equity investment. APChemi's project management consultancy helps clients structure bankable projects with credible financial models that attract institutional investors.

More Pyrolysis Plant Cost Questions

How much does a small pyrolysis machine cost?

A small pyrolysis machine (1–5 TPD batch reactor) costs $20,000–$150,000 for equipment from Chinese or Indian manufacturers. These are suitable for pilot testing or small-scale operations. Turnkey installed cost including civil works and utilities is $50,000–$400,000.

What is the cost of a tire pyrolysis plant?

A tire pyrolysis plant costs $80,000–$600,000 for a 10 TPD system (equipment only). This includes the reactor, condenser, tire shredding line, carbon black discharge, and steel separation. Turnkey installed cost is $200,000–$1.5M. Tire pyrolysis is one of the most popular applications due to multiple revenue streams: oil (40–50%), carbon black (30–35%), steel (10–15%), and gas (10–15%).

What is the cost of a plastic pyrolysis plant?

A plastic pyrolysis plant (also called a plastic-to-oil or waste-to-fuel plant) costs $60,000–$500,000 for a 10 TPD system (equipment only). Plastic pyrolysis yields the highest oil output (60–80%) but requires proper feedstock sorting and washing. With ISCC Plus certification, plastic pyrolysis oil commands premium prices of $700–$1,100/MT in the circular plastics market.

What is the cost of a biomass pyrolysis plant?

A biomass pyrolysis plant costs $50,000–$400,000 for a 10 TPD system — typically 20–40% cheaper than plastic or tire equivalents. Biomass pyrolysis produces biochar (20–35%), bio-oil (30–45%), and syngas (20–30%). The biochar market is growing rapidly due to CDR carbon credits valued at $50–$150/tonne CO₂, making biomass pyrolysis increasingly attractive.

How much does a waste-to-oil plant cost?

A waste-to-oil plant (pyrolysis plant converting waste plastics or tires to oil) costs $60,000–$10M+ depending on capacity. Small 5 TPD units start at $60,000–$150,000 (equipment). Commercial 20–50 TPD turnkey facilities cost $1M–$8M. Large-scale 100+ TPD installations with oil distillation can exceed $25M. Adding oil purification/distillation increases cost by 20–40% but doubles revenue per tonne.

What is the setup cost for a pyrolysis plant?

Total setup cost includes: equipment (40–60% of total), civil works and building (15–25%), utilities and infrastructure (10–15%), installation and commissioning (5–10%), and working capital (5–10%). For a 20 TPD plant, total setup cost ranges from $1M–$3M. APChemi's de-risking approach lets you validate the business case with just 5–8% of total CAPEX before committing to full investment.

Is a pyrolysis plant a good investment?

A well-designed pyrolysis plant can be an excellent investment with typical payback periods of 2–4 years. Key success factors: securing reliable feedstock supply, choosing continuous over batch operation for commercial scale, adding oil purification for premium product pricing, obtaining ISCC Plus certification, and working with experienced partners like APChemi (49+ projects, 12+ patents). The global pyrolysis market is projected to grow from $935M to $1.58B by 2031.

What is the price of pyrolysis oil?

Crude pyrolysis oil sells for $400–$550/MT as industrial fuel. Distilled/purified pyrolysis oil commands $600–$900/MT. ISCC Plus certified oil for the circular plastics market reaches $700–$1,100/MT. Prices vary by quality, certification status, sulphur content, and regional demand. Investing in oil purification technology is the single most impactful way to increase pyrolysis plant profitability.

Get Your Custom Pyrolysis Plant Cost Estimate

Share your project details — feedstock type, target capacity, and location — and APChemi's engineers will provide a detailed cost breakdown with ROI projections within 48 hours. Free of charge.